Golf's Next Round

How the Guest Experience Must Evolve

It's 2005.

Tiger Woods wins The Masters (again). He finishes second at the U.S. Open and a month later, puts together a stunning performance to win The Open championship (again). There’s no golfer more dominant in the world, both on the golf course and off. Woods’s on-course earnings exceeded $10 million in 2005, and while that profit wasn’t directly shared with the golf industry, its impact was felt overall.

We know by now that Woods’s meteoric rise to “transcendent star” status changed the sport forever. Tee sheets were full. Five-hour rounds were the norm at public facilities, and there wasn’t too much uproar about it. Golf was a getaway, an escape from the real world, and spending a chunk of the weekend on manicured greens and busy fairways was no big deal. More importantly, golf was cool.

That’s not to say golf isn’t cool anymore—golf is simply changing. There’s a new generation of stars populating the professional golf landscape, and with that, a new generation of players taking up golf (or taking golf more seriously).

They’re not children of the Woods Era; rather, they’re children of the Fowler, Spieth, and DJ era. These golfers have a different set of expectations for golf, including how long it should take to play and how accessible the game should be.

Turner Sports thought it hit the jackpot in 2018 with Capital One’s The Match on Thanksgiving weekend, a pay-per-view 18-hole showdown between two of the greatest golfers of all time: Tiger Woods and Phil Mickelson. But by all accounts, The Match underwhelmed. Turner had to issue refunds to those who spent $19.99 on a streaming option due to persistent technical difficulties. Woods was 43 years old and Mickelson was 48, and their match came at the end of a PGA TOUR season that saw some of its bright young stars solidify themselves as the world’s best.

A decade or so ago, we had Tiger Fever to excite, motivate, and drive golf participation and somewhat mitigate the emphasis on experience. In 2019, the golf industry faces a new set of challenges: we have a new generation of golfers and an all-new experience to excite and interest players, but it’s up to the industry and its facilities to keep them around.

A rise in technology coupled with a shift in the golf experience have resulted in momentum for golf, as well as a mandate for traditional golf facilities: while nontraditional or alternative golf experiences have shown how the sport can thrive in a new generation, green-grass facilities must first show they are willing to do what it takes to survive.

Is golf getting younger? Is it appealing to a younger audience? In some ways, yes. In others, there’s some work to do.

An organization called WE ARE GOLF released its most recent U.S. Golf Economy Report for National Golf Day in May 2018. In the report, key trends in demographics and the industry itself were detailed, providing the beginning of a road map for golf courses looking to progressively improve their experience. To understand how golf is changing and why the experience must evolve, we must also understand who is necessitating the need for change and re-shaping how golf is played, followed, and consumed.

Kids are taking up golf, which is encouraging. Since 2011, there has been a 20% increase in junior golf participation in the United States, which equates to approximately 500,000 kids—33% of whom are girls. This is a generation that lives on-demand and is driven by a “digitally available” way of life, meaning everything they need is typically accessible via technology—communication, transportation, and essential utilities. In a general sense, such a demographic doesn’t jive well with golf, but they’ve indicated an interest to pursue the sport, making it paramount for the golf industry to adapt.

The evolution of technology in golf is something we will cover further in this piece, but it was also highlighted by the U.S. Golf Economy Report. With trends toward gamification in several industries, golf has jumped on board and done so by incorporating technology into what are considered nontraditional or alternative golf facilities. We’re talking about experiences like Topgolf, a company that has merged gamification and technology in an effort to broaden the appeal of golf and move it into a more casual setting.

The number of alternative golf facilities now exceeds 2,300 in the United States, grossing $1.31 billion in revenue, which is a significant boost to the industry.

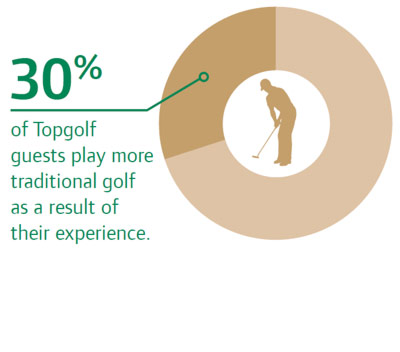

But does this gamification trend have an impact on the green-grass golf industry? The data say “yes.” Alternative golf facilities serve as a bridge to the on-course experience, but that leads us to an important point: because the golf experience at Topgolf is viewed as overwhelmingly positive, approachable, and fun, traditional golf facilities must do their part to provide an equally entertaining experience.

Nearly 30% of Topgolf guests say they play more traditional golf as a result of their experience, and 23% say the Topgolf experience has resulted in an increased desire to follow golf more closely. In addition, latent interest—those who indicated they would consider playing green-grass golf in the future—was reported at 53% by Topgolf guests.

These numbers prove what we feel in the golf industry: there’s interest in the sport and that interest is increasing, but it’s critical that we acknowledge the need for evolution (and make it happen).

The consensus among golf professionals—both in the public and private facility realms—is that nontraditional golf experiences are good for the present and future of golf. They’re a door-opener and a noninvasive one at that, introducing golf with a hybrid of gamification and technology, which are two pillars of any modern entertainment offering.

Columbus Country Club is one of Ohio’s oldest and most storied clubs, a Donald Ross gem that opened in 1903 on the capital city’s east side. Over the last two years, the club has undergone a transformation geared toward attracting a younger membership, which has worked; the Columbus Country Club member’s average age is 39 years old, and that number may decrease again in 2019. Ryan Coll, the club’s Director of Golf, says clubs should embrace nontraditional golf experiences and use them as a springboard.

“There are hundreds of people in a Topgolf facility, and only a few of them have a golf swing,” said Coll. “This is exposing so many people to golf, and all they’re doing is picking up a club and hitting a ball at a target. There’s no negative to it, in my mind. It’s all positive.”

Giving the customer what they’re looking for may sound simple in theory, but while traditional golf facilities can’t truly replicate what a nontraditional facility provides, they can incorporate the most appealing elements into their offering. What does that mean for the golf course manager or the head pro? It means paying close attention to what’s actually bringing people into golf and keeping them around.

“Timing is key. Technology is important, and uniqueness is important,” said Coll. “How do we make golf easier and more approachable?”

A round of green-grass golf can take in excess of five hours on a weekend, while a night at Topgolf is one or two hours. This, according to golf course managers, is a major hurdle.

“What we have to look at in the industry, and what we have to do, is find golf courses with 3-hole routes, 6-hole routes, 9-hole routes, so these people can have fun and enjoy themselves,” said Coll.

“This has to be something they can do with their friends.”

There’s still air time for Tiger (and maybe Phil), but the next wave of golfers in the United States is growing up with Justin Thomas, Rickie Fowler, Jordan Spieth, Brooks Koepka, Dustin Johnson, and Rory McIlroy. How are these fresh faces—and their “always on” approach to social media and engagement—changing the way we follow golf? How has that had an impact on the game?

The access to players in 2019 is unparalleled and in stark contrast to the mystique and allure of Woods’s heyday. Through technology and social media, these superstars give fans a window into their lives on a near-daily basis and make golf seem closer than it’s ever been. Coupled with an easy-access experience like Topgolf, golf is taking on a younger personality.

No Laying Up, a prominent golf multimedia property operated by a team of Millennials who took up golf coverage as a hobby, uses its social media presence on Twitter, Instagram, and YouTube to reach hundreds of thousands of followers on a daily basis. They often interact with the game’s bright young stars—Thomas and McIlroy have appeared on No Laying Up’s popular podcast multiple times —and have developed video content series that are sponsored by Callaway Golf, BMW, and other brands. “[This evolution] is changing people’s opinion of the game without us [traditional golf] saying a word,” Coll said. “We’re more connected to golf than at any point I can remember.”

Where do golf facilities turn next? Industry experts believe the approach must begin with extracting the major appealing elements of nontraditional golf facilities and incorporating them into the traditional golf experience.

One golf professional from a public facility in the U.S. Midwest cautions that while these ideas seem reasonable, feasible, and executable, the challenge is almost always going to involve money. Implementing change is expensive, but using available information, such as the 2018 golf economy report, can start important conversations that may, in some cases, lead to landmark decisions.

Trevor Spathelf of the Tennessee Golf Foundation, an organization that puts on more than 145 events each year across the state, said technology and evolution in the golf experience is no longer optional. It’s expected.

“So many people are getting into golf through this new entertainment-focused realm,” said Spathelf. “The important thing is how we apply what (people) like from that environment into the traditional environment.”

“You’re seeing instant data through TracMan at private facilities, and for events and public facilities, just having speakers and USB ports in golf cars get rave reviews from people. They love it, and it drives home that golf should be fun and entertaining.”

Coll, who runs a private facility with a nearly capped membership, said Columbus Country Club’s pivot to technology is already underway.

Coll has ordered portable speakers with the club’s logo, which will be sold in the pro shop this season, along with charging cables and other accessories members may need. Their new fleet of golf cars will include USB ports for each player, and he’s had discussions with members encouraging them to take advantage, play music, and have fun on the golf course.

“Technology costs money—and it’s hard to make money in this industry,” Coll added. “But we’re seeing the benefits of doing so. Our membership is engaged, they’re on board, and they want to keep having fun playing golf. That’s what keeps them around and, frankly, keeps us going as a club. They can put the speakers on their cars, plug into the USB, and do their thing. Music is becoming a huge factor in golf, and people love listening to it when they’re playing.”

Take the Shark Experience, which Club Car developed in partnership with World Golf Hall of Famer Greg Norman and Verizon. Designed with the future of golf in mind and featuring hole flyovers, pro tips, and easy access to music and entertainment, the Shark Experience gives golfers what they want: a good time on the course.

“I had a member go out in one of those carts and from that point forward he said, ‘I don’t want any of the old carts. I want the Shark cart,’” said Larry King Jr., owner of Cheval Golf & Athletic Club in Tampa, Florida. “How could that person ever go back to a cart with a plastic menu and a paper pin sheet in it? He’s not going to. He’s beyond that.”

Golf course managers, directors of golf, observers of the game ... they all agree that this evolution—and in some ways, revolution —of golf is not a phase. It’s here to stay. Technology has brought the game closer to a younger demographic and opened the door to a new audience all in one fell swoop, but this change has also left many facilities playing catch-up. What we in the golf industry can learn from the data, opinions, and observations contained in this piece is that adaptation of technology will be the catalyst for success.

Integrating technology gives your facility the best opportunity to capitalize on the 53% of nontraditional golf customers who indicate an interest in green-grass golf. A few years ago, the identity and makeup of golf’s next round was unclear and somewhat ominous; now, there’s a clear path forward, one that will inject excitement and energy into the golf experience.

With more than 60 years of experience servicing the golf industry, ClubCar has developed technology to match the changing demands of the game and its consumers. We’ll partner with you to find the best path forward, one that involves high-quality and versatile equipment and a keen eye on the future of golf.

For more information, or to request an onsite demo, visit clubcar.com