leasing your club car

A guide to leasing or buying a small task oriented vehicle

What are "small task oriented vehicles?"

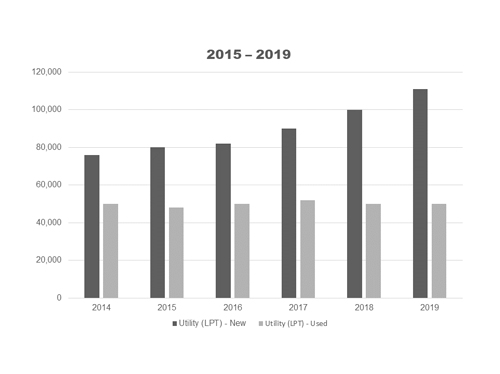

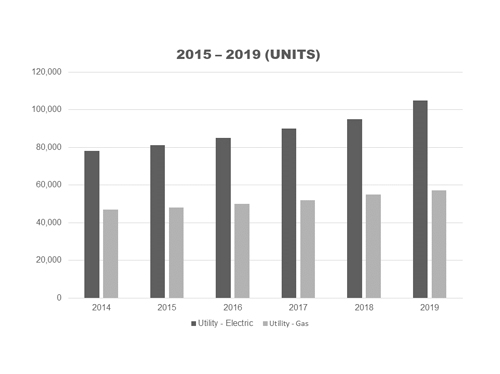

Simply put, small task-oriented vehicles (STOV) are tools that move people and equipment in a wide variety of industries to get work done or to move people and guests from place to place. Think golf carts at golf courses, utility vehicles on college campuses, 4x4 UTVs used to pick up trash on the sides of the interstate, or multi-passenger vehicles to move people safely through airports. There are a multitude of tasks that can be accomplished by utility vehicles, and for each task the right vehicle is essential. A study by Small Vehicle Resource found that the adoption of “light duty” utility and transportation vehicles is on the rise (Figure 1), especially electric (Figure 2) in campus environments, industrial complexes, and municipalities.

Calculating the total cost of ownership

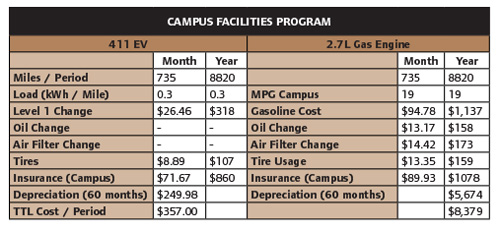

Both the versatility of these vehicles available in the market and a generally lower cost of acquisition and maintenance as compared to full-size vehicles also known as Total Cost of Ownership (TCO Figure 3) make them an attractive option for moving people or payloads.

Yet even with capabilities similar to full-size autos, the vast majority of commercial or government buyers are choosing to purchase STOVs like tools or supplies, as opposed to leasing or financing like trucks and heavy equipment.

In going the capital acquisition route, buyers can be limited by tight annual budgets and competing needs often leading to fewer vehicles being procured than are needed. Worse yet, limited budgets lead to the repurposing of vehicles that are not “fit for use” resulting in questionable safety and environmental considerations (Figure 4 and Figure 5).

Lastly, committing year after year to keep certain equipment that is long past expiration means there is always the potential for high maintenance costs and significant downtime resulting in reduced productivity.

Buy and Hold ... it works for stocks right?

There is evidence that buying quality items and holding on to them for a long time can provide tremendous value or ROI (return on investment).

For example, if you had bought one $40 share of stock in Coca-Cola in 1919 during its initial public offering, your one share would be worth $394,500 today. All you’d have to do is wait 100 years! However, buyers must consider the Total Cost of Ownership. Think about that box full of VHS tapes and DVDs in the closet (not your closet, of course). For the cost of those fifty movies purchased at $15 each, you could have rented hundreds of movies. So clearly, some things are worth buying and holding while others are clearly worth renting. In the case of small task-oriented vehicles, the route might not be as clear, but there are many options no matter the direction chosen.

The Options

History shows that STOVs are predominately budgeted for annually and purchased with cash because most decision-makers do not realize there is an option to lease or finance. When speaking with procurement personnel, the first reaction often to the question, “would you like a lease quote” is, “we don’t lease”. In most cases, a sales professional will just drop it at this point. Yet, by probing further it is likely that the buyer can in fact lease or finance the purchase, they just need to be open to a new process or open to extending existing processes to a new category of procurement. In doing so, both buyer and seller may come to the conclusion that there is a way to reduce costs, increase productivity, improve safety, and reduce other operational costs through leasing or financing. The fact is, the Federal Government can and does lease, as do state and local governments, colleges and universities, and of course private enterprises of all types. What’s holding many buyers back is not the ability to lease or finance, but the willingness to take the additional measures necessary to do so, and thus may be leaving a logical alternative on the table. Of course, before making any decisions on the method of procurement, it’s important to have a solid understanding of the pros and cons of each, so let’s review.

Capital Acquistion AKA “The Status Quo”

Buying new Small Task-Oriented Vehicles has its benefits. New vehicles need little maintenance, perform at their best, and often have warranties from 1 – 4 years depending on the brand and the components covered. CAPEX also may have beneficial tax implications based on your location, but as always, check with your tax advisor first. Whether you’re the decision-maker or are required to go through procurement, for everyone involved a cash transaction is likely to be the easiest. The biggest challenge for simply “cutting a check” is having the dedicated funds for that purchase in the first place. Budget dollars may have initially been planned for specific spend on STOV, but given the nature of budgets, things change and that bucket may either be empty by the time you need it or coopted for more pressing needs.

Financing AKA “What your mom or dad would tell you to do."

Financing of Small Task-Oriented Vehicles, sometimes called a Conditional Sales Contract, is a way to avoid large upfront costs, while still maintaining control of the asset at the end of payments. Like buying outright, there may be certain advantages to financing your purchase especially if the vehicles you finance are intended to last 8 or more years. That’s a tall order for some STOVs but if well maintained and properly used, not outside the norm. The true costs come generally not in the years the vehicle is financed (3, 4, maybe 5) but in those years beyond. When the vehicle is out of warranty and still in use daily, the maintenance costs can start to add up and any downtime can affect operations. While financing may provide some cash flow relief, it does come with a higher level of difficulty from the procurement perspective and if you are a non-profit or a government agency, a financing package where the equipment is owned at the end may be the only installment option afforded to you by federal, state, or local regulation.

Fair Market Value Lease AKA “Renting”

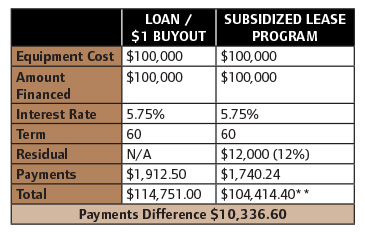

An FMV lease is essentially a long term rental with a set period, a set payment, a set interest rate, and a residual value that may enable you to buy the vehicle at the end or turn it in for new equipment. An FMV lease often requires no upfront cost (payment in arrears) and can be structured so that the payments match your needs. In other words, longer term, lower payments, the shorter the term the sooner you can swap for new vehicles with newer technology. Many can also be structured to match the seasonality of cash flow for example if your business relies on customers April – December, you could structure a lease where no payments are due January - March. An FMV lease provides a lot of flexibility, but as with a financed deal, it does require a lot more paperwork and ground game at the start. That said, the extra effort at the beginning could save your organization thousands of dollars over the life of the lease as demonstrated in Figure 6. Simply put an FMV lease allows for the greatest flexibility and improved cash flow allowing more cash to be on hand for other opportunities.

*Payments and rates may vary. Subject to credit review, approval and other terms and conditions.

** Not including possible tax benefit. Always consult a qualified tax advisor. Nothing herein constitutes tax.

Pending the product selected, an advance payment may be required and will vary based on payment terms selected. These materials are for informational purposes only.

Other Considerations and Final Thoughts

It is important to note that regardless of the type of transaction, purchase, finance, or lease, the manufacturer’s warranty is not affected. Also, if you are a non-profit or tax-supported organization, it is likely that you have access to cooperative purchasing that may enable you to avoid the bid process prior to your decision of how to actually pay for the vehicles.

In the end, the supplier and dealer are happy just to have you as a customer. The question is will you have the ability to be a customer because as we all know budget plans change, priorities change. Financing or leasing your small task-oriented vehicles can help you execute your transportation strategies without the fear of losing the resources you need to procure them.